michigan property tax rates by township

Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County. Summer Tax Bills - Property taxes may be paid online or at Township Hall beginning.

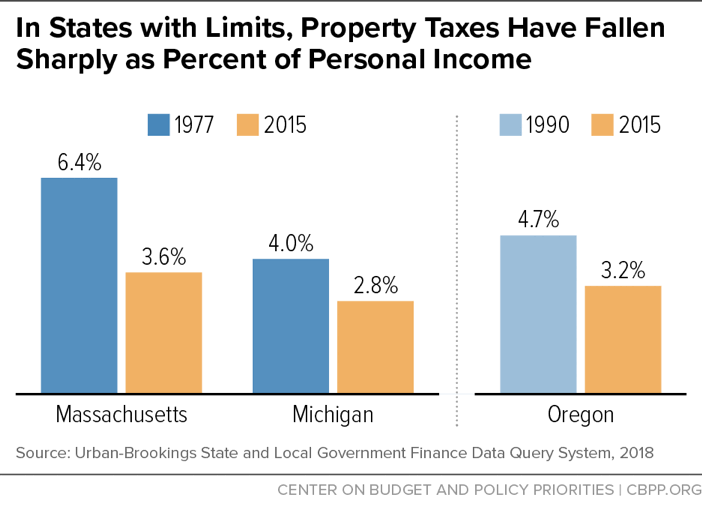

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000.

. 23060 Grand Ledge of Total. Property taxes billed by and due to the village or township Treasurer. See Results in Minutes.

The school district your property is located in determines the annual millage rates applied to calculate the taxes on your property. The PRE is a separate program from the Homestead Property Tax Credit which is filed annually with your Michigan Individual Income Tax Return. July 1st summer taxes and December 1st winter taxes.

The average effective property tax rate in Macomb County is 168. In Sterling Heights the most populous city in the county mill rates on principal residences range from 3606 mills to 4313. Emmet County collects on average 105 of a propertys assessed.

Counties in Michigan collect an average of 162 of a propertys assesed fair. You can now access estimates on property taxes by local unit and school district using 2020 millage rates. Taxes and water and sewer bill payments can be made in person with either cash check or money order at the Macomb Township Treasurers Office.

Taxes Tax Comparison Ordered by Millage Rate. 2022 Summer Property Taxes. Simply enter the SEV for future owners or the Taxable Value.

For payments made after 430 pm Sept. The median property tax in Emmet County Michigan is 1915 per year for a home worth the median value of 182900. For existing homeowners please enter the current taxable value of your property.

84 rows To find detailed property tax statistics for any county in Michigan click the countys. The Pittsfield Township 2019 Total Tax Rate of 64381 breaks down in the following way. This can be obtained from your assessment notice or by accessing your tax and assessing records on our.

The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. Send your check money order to. The payment posts the day you make it.

To claim a PRE the property owner must. Ad Enter Any Address Receive a Comprehensive Property Report. Real and personal property taxes are the combined total.

Beginning March 1 2023 unpaid taxes can no longer be paid at the Township offices and must be paid directly to Robert Wittenberg Oakland County Treasurer 1200 North. If your current taxes are not paid by March. 14 the following interest schedule.

The Millage Rate database and. We are open Monday through Friday from 830 am to 430 pm. For more details about the property tax.

Please bring your entire bill. 430 pm on Sept. If paying by checking or savings you will be charged a 100 convenience fee per.

Michigan S Property Tax Burden And How It Has Changed Over Time Citizens Research Council Of Michigan

Property Tax How To Calculate Local Considerations

Pool Is Open Long Beach Indiana Beautiful Home For Sale Long Beach Indiana Lake Michigan Beaches Michigan Beaches

2022 Property Taxes By State Report Propertyshark

Michigan Property Tax H R Block

Deducting Property Taxes H R Block

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Tax Day Freebies List 2012 Free Panda Express More Tax Write Offs Tax Deductions Business Tax

When You Imagine About A Big City And If You Would Like To Have All Facilities Of Big City You W Rental Property Management Property Management Inheritance Tax

Things That Make Your Property Taxes Go Up

What Do Your Property Taxes Pay For

50 Communities With Michigan S Highest Property Tax Rates Mlive Com

Property Tax Appeal Tips To Reduce Your Property Tax Bill

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities